Use Mortgage Calculator for A Better Financial Planning

Mortgage Calculator for A Better Financial Planning. After short time my family bought a new house, we realised that it would be beneficial for us to develop financial competencies before we make any kind of financial decisions.

This specific competency can be found as the result of learning whether informally from the internet or through financial education.

Mortgage loans are complex financial products provided by banks as the important financial institutions and typically the longest and the largest loan that most people take out throughout their entire life.

A lot of people have a basic understanding of what goes into a mortgage but they don’t understand the entire inner workings of a mortgage.

In this article, you will know about four factors of mortgage payment, mortgage product types, as well as the usage of a mortgage calculator.

Four Factors of Mortgage Payment

Four factors go into a mortgage payment.

- Principal (P)

- Interest (I)

- Taxes (T)

- Insurance (I)

Let’s run through this briefly

1. Principal (P)

A principal is the amount of money that you owe the bank for lending you to be able to purchase the house that you’re moving into.

For example,

If you want to buy £ 400.000 and requires a down payment of 20%.

Then you need to pay £ 80.000 and you owe £ 320.000 on the mortgage.

2. Interest (I)

Interest is the rate at which you are borrowing money from the bank. The higher risk you are meaning the lower your credit score you are and the higher the rate that the bank needs to make to compensate themselves for taking on risk.

In the other words, you are going to get a higher interest rate on your mortgage.

Higher risk = higher rate of interest.

Lower risk = lower rate of interest.

The better your credit score, the lower the interest is going to be.

3. Taxes (T)

Property taxes are used to help fund schools infrastructure, government workers and are part of owning a home.

These taxes are typically calculated on the assessed value of the home and the lender can roll these into your mortgage payment.

They’re going to be escrowed meaning they’re going to be set aside in a special account and once they’re done typically twice a year that’s going to be paid to the municipality that they’re owed so the taxes will get rolled into your mortgage payment in most cases.

4. Insurance (I)

Your house mortgage can take up to may years, even more than twenty years. You need to secure your financial condition during rainy days when you have to make payments or your house will be at risk.

When you live in UK, you probably know Mortgage Payment Protection Insurance (MPPI).

Mortgage Payment Protection Insurance guarantee there will be a payment to pay off your mortgage when you don’t receive monthly income.

Mortgage Product Types

1. Fixed-Rate Mortgage

These mortgages can be offered in 10, 15, 20, or 30-year increments, the most popular being the 15 and the 30 with the 30 being the most popular overall.

A Fixed-rate mortgage means the interest portion of this loan over the term (10, 15, 20, or 30 years) or the interest rate never changes.

2. Adjustable-Rate Mortgage (ARM)

This type of mortgage has a rate that’s fixed for a specific period.

For example 3/1, 2/5,

It’s fixed for a certain period and then it adjusts over time depending on the second number.

By 3/1 ARM means the first 3 years is fixed and it adjusts annually every year after that.

This rate is based on the one-year treasury bills or LIBOR (London Interbank Offered Rate).

By 2/5 ARM means the first 2 years is fixed and it is also fixed for every 5 years after that. It adjusts every 5 years after that.

This type of mortgage usually benefits people that don’t want to have a mortgage for long or who feel like interest rates are going to be going down.

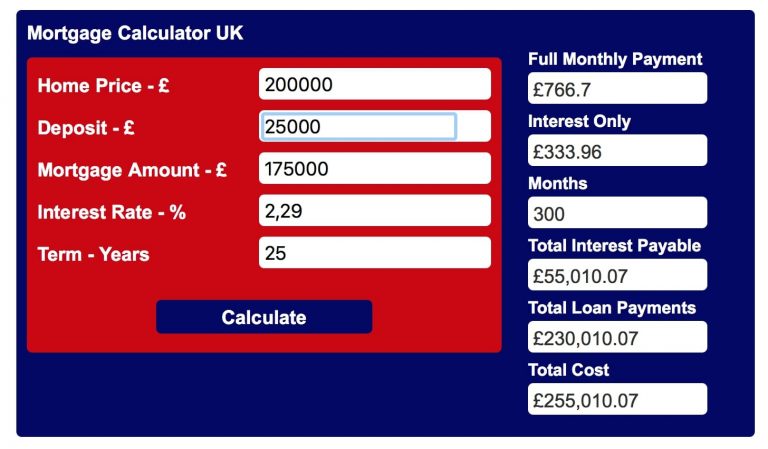

Estimate Your Monthly Mortgage Payments

Future home buyers can use the mortgage calculator to find out the monthly rate for repaying the real estate loan. This information is important for the prospective loanee to assess whether he can afford such a house.

You will also receive information on the amount of mortgage interest. Anyone who also wants to know how long they have to pay off their home purchase financing will also get an answer from the calculator.

How to Use Mortgage Calculator

The mortgage calculator is easy to understand and clearly structured. At first, enter how much the favored object costs in the appropriate field. A loan amount must also be specified. To calculate this, the prospective creditor adds the additional costs to the purchase price. They are made up of:

Land Registration Fees

notary fees

property transfer tax

if applicable, expenses for brokers

Now deduct the available equity from the sum of the purchase price and ancillary costs. The home buyer enters the result in the Loan Amount field. So that the prospective borrower can plan with fixed mortgage interest rates for several years, he also sets a debit interest rate commitment of 5 to 30 years. You don’t have to worry about the amount of the debit interest – the mortgage calculator automatically calculates a value. The prospective borrower also has the option of setting the date of the first installment.

As soon as this basic information about mortgage financing has been stored, it is time to choose a suitable repayment. Depending on personal preference, the home buyer chooses one of these repayment options:

Amortization rate (default)

Specification of the monthly rate

Full repayment with fixed interest rate

Full repayment in xx years

no repayment (repayment suspension)

Real Estate Can Affect Your Lifestyle

Make sure you have a better understanding of how the mortgage works and if you should overpay your mortgage.

I learned a lot about it including to decide whether my family should make lump sump or monthly payments through MortgageCalculatorUk website and see how much we can save.

Finally, to recap: Buying a house is entirely legal! If that is your heart’s desire and you have sufficient equity, go for it! Just be aware that it is a lifestyle choice rather than a good investment.

Stay safe … xoxo

You May Also Like

Meningkatkan Kualitas Diri, Self Discovery Day 2

Oktober 2, 2020

Waktu yang Tak Pernah Cukup, Self Discovery Day 5

Oktober 5, 2020